Since the 1990s, globalisation has been associated with a sharp drop in rich nations’ share of world income, world manufacturing and world exports. The big winners are a handful of developing nations who have industrialised by joining, rather than building, supply chains (think Thailand or China versus South Korea). This rapid industrialisation also lifted the boats of a wide range of commodity exporters.

The radically different impact of this globalisation is due largely to its very different nature. When firms offshore production stages they must also offshore their firm-specific managerial and technical know-how. As such, supply chain trade involves a great deal more ‘technology transfer’ than traditional trade. This opened a new motorway to industrialisation that involves joining a supply chain rather than building one.

While joining a supply chain poses new challenges, joining is a lot faster than building. As the advance-technology firms fill in any missing competency, developing nation factories can, within months, export world-class manufactured goods — a feat that used to take decades when nations had to build up an industrial base before they became globally competitive (think US, Japan, Germany and South Korea).

The final big change was the way offshoring killed import substitution. Many of the developing nations that received offshore factories have now become hyper-competitive thus wiping out the exports of developing nations that clung to import-substitution industrialisation.

Firms that offshore production need two key assurances: that they can seamlessly connect factories and that they can safely do business abroad. The first involves things like removal of border barriers, excellent infrastructure services and assured business mobility; the second involves guaranteeing of tangible and intangible property rights. While WTO rules touch on some aspects of these, they are not sufficient for a world where global value chains are pervasive in several manufacturing sectors.

The necessary disciplines did emerge since internationalising production networks are a win-win. High-tech firms gain from locating in low-wage nations if they have the two key assurances mentioned above. Developing nations win fast-track industrialisation if they can attract many offshored factories. Little wonder then that developing nations willingly lowered tariffs and eagerly signed up for deep disciplines in regional trade agreements and bilateral investment treaties. In a sense, old-fashioned protectionism became destructionism in supply-chain industries.

This happened regionally, rather than multilaterally, for three key reasons. First, most supply chains are regional and the two-key assurances are not obviously discriminatory, so regionalism was the natural route. Second, while multilateral rules governing supply chain trade would have been preferable, the WTO was otherwise occupied with the Doha Round and its steady focus on 20th century trade issues. Third, politics of offshoring tend to be bilateral by their very nature. If Thailand wants Japanese factories, it signs with Tokyo; if Costa Rica wants US factories, it signs with Washington. Since there are no factories on offer in Geneva, why discuss supply chain rules in the WTO?

The bilateral route to supply-chain governance has long been recognised as a threat to the WTO’s centricity. Things, however, have recently turned much more serious. Advanced-technology nations, especially the United States, are leading efforts to knit together the current array of ad hoc governance into ‘mega-regionals’ — including the Trans-Pacific Partnership (TPP) and Trans-Atlantic Partnership — and mega-bilaterals, such as the EU–Canada and Japan–EU FTAs.

President Obama hopes to conclude TPP negotiations by the end of 2013. If this works, and the other mega-regionals finish, the rules for supply chain trade will have been harmonised plurilaterally by the end of the decade — entirely outside the WTO’s ambit. There will be a new pillar of international trade governance, but one with a very worrying feature. On their current trajectory, the mega-regionals will not include the new trade giants like China, India or Brazil, and global trade governance will be marked by fragmentation and exclusion.

The most natural means of avoiding this emergent fragmentation and exclusion would be to multilateralise regional supply chain disciplines into the WTO. Yet the WTO does not seem well suited to the task. The WTO seems incapable of getting beyond the Doha negotiations, and until it does, it is incapable of addressing supply chain governance. The nature of supply chain governance also calls for a very different organisation. Supply chains are mostly about making things internationally, while today’s WTO, WTO 1.0 as it were, rules are primarily aimed at governing the international selling of things.

The argument for a new trade organisation boils down to profound differences between supply chain trade and traditional trade. Today’s WTO works well for traditional trade. But it is only tangentially relevant to supply chain trade, since its rules have not been updated since 1994 — just about the time when supply chain trade took off.

All the key mismatches between WTO 1.0 and supply chain trade stem from the fact that supply chain trade is much more complex and asymmetric than traditional trade. Today’s WTO is crafted to facilitate traditional trade — its nature, membership and rules are designed to support international selling. Supply chain trade, by contrast, enjoys little or no global regulation. Put differently, WTO 1.0 is a set of rules and procedures that facilitate the negotiation of and locking in of exchanges of market access. It solves a prisoners’ dilemma, shifting a lose-lose outcome of high tariffs to a win-win outcome of open markets. This, however, has almost nothing to do with the disciplines needed to underpin international production networks.

A multilateral agreement on supply-chain disciplines would create a win-win outcome by locking in pro-supply-chain reforms that nations made voluntarily. The cooperation should thus not be thought of as a prisoner’s dilemma game, but rather a credibility game.

As the nature of cooperation is different, the international organisation that coordinates it must also be different. For example, special and differential treatment has little sense when it comes to supply-chain rules. The whole point is to boost credibility, so special and differential treatment of developing nation members would be counterproductive. Any nation that asked for laxer rules would surely see an outflow of its supply-chain industry.

The new organisation — let’s call it WTO 2.0 — should also start with a restrained membership. Since only a few dozen nations have a large stake in supply chain trade (leaving out raw material), there is little logic to universal membership in the WTO 2.0. Moreover, insisting on universal membership is likely to substantially hinder cooperation. Supply-chain non-participants may be tempted to extract gains by linking their agreement to proceed to unrelated, old trade issues.

The WTO’s structure makes it incapable of hosting the new supply chain trade rules. Its DNA is based on enlightened mercantilism, whereby nations agree to open their own markets if other nations reciprocate. Supply chain trade, however, is much more asymmetric and cooperation is based on locking in assurances that underpin international production networks. To reduce the fragmentation and exclusion that is emerging with mega-regionals, we will need a WTO 2.0.

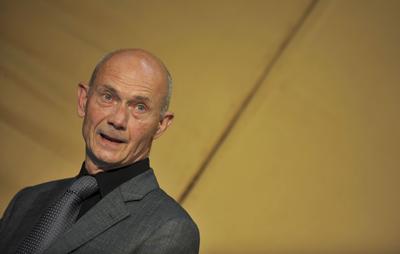

Richard Baldwin is Professor of International Economics at the Graduate Institute, Geneva, and part-time Visiting Research Professor at the University of Oxford.