But with the global economy in 2016 off to one of its worst starts in decades and China’s economy weakening, this prediction of 7.8 per cent growth in 2016 might not be realised.

India’s declining exports are a key indicator of the country’s waning economic vitality. The last financial year was one of the worst years for the global economy since the global financial crisis of 2008, with global trade growth collapsing to almost 0 per cent in 2015. As a result, India’s exports growth fell to –5 per cent with the cumulative value of exports down by 18.5 per cent for April–November 2015 compared to the previous year. These figures depict a scenario even worse than 2008–09.

The country’s corporate sector is reeling — India’s top 500 companies experienced zero revenue growth in 2015. The profits of Sensex (India’s major stock index) companies rose by only 1 per cent during the April–June quarter, compared with 24 per cent growth in the same period a year earlier. Profit growth in 2016,as forecasted by Morgan Stanley Investment Management, is likely to be negative for the financial year. According to these indicators, India’s prospects of achieving the predicted growth rate seem very grim indeed.

Rupee depreciation is another indicator that contradicts the GDP growth forecast. The rupee, which weakened by 5 per cent against the US dollar in 2015, is forecast to fall below 70 rupees to the dollar in 2016. Despite its strong fundamentals, the US rate hike, turmoil in Chinese markets and deflationary pressure in advanced economies will hurt the rupee.

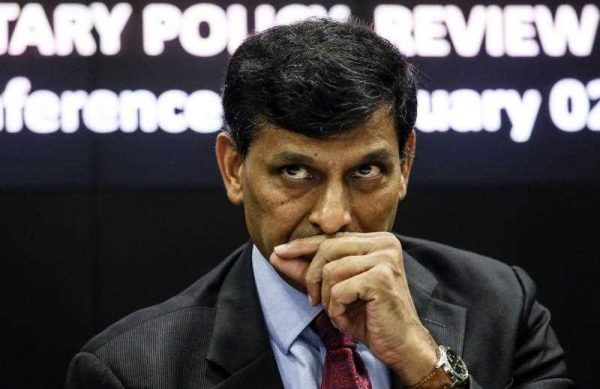

It is possible that spill over effects from these global slowdowns will lead to slower growth, lower corporate earnings and more volatility in India’s currency market. Slowdown in the Chinese economy and yuan depreciation will continue to adversely affect Indian markets, as noted by Reserve Bank of India governor Raghuram Rajan. This will cause further damage to the GDP growth rate in 2016.

India’s substandard banking system is also impeding growth. Credit growth, which was 25 per cent in 2007, has fallen dramatically to 9 per cent in 2015. This is mainly due to growing levels of bad loans as well as non-performing and stressed assets held by public sector banks.

In late June last year, bad loans and stressed assets together accounted for more than 14 per cent of all assets, compared with just 4.8 per cent for the more disciplined and profit-motivated private sector banks. This is concerning as India’s private banks account for only a quarter of all lending. As debt continues to grow, core sectors such as infrastructure, mining, iron, steel and power will continue to face a credit crunch.

India is becoming one of the most protectionist countries in the world. According to the Centre for Economic Policy Research, the United States, India and Russia have imposed the most ‘trade distorting’ measures since 2008. India, like Russia, has hit nine of the other top 20 global economies with protectionist measures more than 150 times since November 2008. India imposed 504 protectionist measures between 2008 and 2015. This surge in protectionist measures saps trade, hampering India’s economic growth. It must be rectified urgently.

The success of India’s economy in the years ahead depends on a few key factors. Trade liberalisation and banking system reforms are urgently needed. The government needs to make proactive and sustained efforts to aid export sector growth, integrate India into global value chains and improve ease of doing business in the country. On the political front, parliamentary polarisation must be overcome if India is to implement important policies like the goods and services tax (GST) and land acquisition reform.

India’s economy will not live up to expectations in 2016 unless the necessary steps are taken soon.

Richa Sekhani is a Research Assistant at the Observer Research Foundation, New Delhi.

This is the first analysis of India I have read in the last 1+ year that has not mentioned PM Modi. The author did not blame Modi for the problems described. Neither did he name the PM as the agent of change needed for the country to overcome its challenges. Was Modi’s prospective role in the months to come implied via the use of the term ‘the government?’ What can Modi do to help the situation?

Hi Richard,

I am glad that you took a note of it. PM Modi and his government can probably take the necessary steps to make India more business friendly and by sheer determination and through conversation with the opposition party get important bills like GST bill passed this time. I guess what India needs to focus in on domestic reforms right now.

Thanks, Richa, for your reply.

Does Modi have the patience and persistence to do what you suggested? Admittedly, I am looking at this from afar. But it seems to me that Modi is great at making grand and sometimes dramatic gestures. However, I rarely have heard of active follow up or implementation of his ideas.

Will the workers of India will benefit from PM Modi’s government or will they continue to be view as a cheap source of labor especially, now that Chinese workers are demanding better wages for the last few years?