China ascended to a position of global trade leadership through the 2012–17 period as domestic governance of its trade and industry policy became acutely important to the global economy.

For the coming 2018–22 period, a reinvigoration of Party ideology will give the State Council the proto-policy necessary to realise its ‘global civilisation‘ narrative as the global trade agenda shifts away from US-led globalisation. The nature and direction of China’s geoindustrial policy will play an important role in determining to what extent this narrative is put into practice.

In the first Xi administration, industrial policy was steered towards orchestrating China’s rise up the global value chain and facilitating the movement of fixed capital to external geographies. But five-year administrations are long enough for factional politics to ebb and flow and the 2013–14 policy narrative that called for the market to play a decisive role seems like forgotten history now.

China’s trade strategy for the second Xi administration will be dominated by the interplay between international capacity cooperation and supply-side reform. Capacity cooperation offshores China’s industrial capacity to external geographies, while supply-side reform cleans up old industrial capacity at home.

Taken together, these two policies result in a contiguous domestic industrial policy that directly affects the global economy and challenges international trade norms, as it is established behind a closed capital account.

While supply-side reform and capacity cooperation are synergistic policies, there is likely to be friction in domestic implementation. Supply-side reform restricts capital for state-owned enterprises (SOEs), which predominantly manufacture domestically. By contrast, capacity cooperation grants easy policy loans to SOEs going abroad to manufacture.

This is designed to provide an incentive to move capacity abroad, to migrate to higher value-added manufacturing at home and abroad, as well as to curb capacity in low-end polluting traditional industries. The exemplification of this policy synergy would be a Hebei-based SOE steel producer transforming into a robotics manufacturer producing out of East Africa.

The Ministry of Industry and Information Technology (MIIT) is tasked with policy implementation of strategic emerging industries such as biotech, new energy, new materials, new energy vehicles, advanced manufacturing, high technology services and digital creative industries.

The challenge for MIIT over the coming five-year term will be to coordinate these new innovation-based policies with that of the macro Made in China 2025 industrial policy — all of which is to be done while coordinating with subnational industrial policy clusters that are responsible for implementing national-level strategy.

National manufacturing innovation platforms will launch intelligent manufacturing pilot projects under the Internet Plus policy nexus of Industrie 4.0 projects. The aim will be to improve and transform processes, materials and standards in industrial manufacturing. This supports macro industrial strategies, which remain focused on the production of large aircraft, aircraft engines, gas turbines, energy equipment, new energy, nuclear energy, high-speed rail and other high-end equipment.

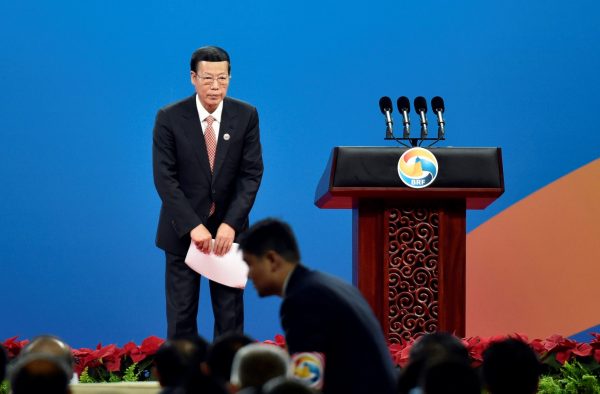

The critical policy implementation at the State Council level in Xi’s second term will largely depend on filling the political vacuum created by the vacating First Vice-Premier Zhang Gaoli. From overseeing economic integration with Kazakhstan to coordinating Jingjinji regional integration to spearheading environmental and energy policy, Zhang has been everywhere at once in this past five-year term. Xi’s focus on power consolidation has been possible largely because Zhang was effectively running the economy.

For the 2018–22 ‘New Era’ post-reform agenda, the degree to which individual firms will be subject to market conditions is likely to be dependent on how effective China’s domestic industrial policy aligns with its international geoindustrial policy.

If supply-side reform succeeds in consolidating SOEs, in helping them deleverage debt and overcapacity and in enveloping them in international production and trade, then we may see a green light for more subnational SOEs to continue ‘business as usual’ as they collect on policy loans and tax concessions to upgrade their production practices under international capacity cooperation.

But if capacity cooperation falls flat abroad, then tighter capital controls at home may disincentivise Chinese SOE managers from investing in fixed assets abroad. International trade in industrials would thus continue to be characterised by dumping domestic product on international markets.

If that happens, then the 2018–22 period could see a softening of industrial policy and a resurgence of a reempowered market-liberal agenda from the currently marginalised Hu Jintao and Jiang Zemin political factions.

Tristan Kenderdine is Research Director at Future Risk.