Areas of trade, technology and investment ties off-limits to two-way flows would extend to 28 categories of critical infrastructure, as listed in a proposed US Treasury Department rule, and also evidenced in the US global campaign against Huawei’s 5G rollout; 14 representative categories of critical emerging technologies, as proposed by the US Commerce Department, and also as evidenced in export licenses denied or indictments brought against Huawei, Fujian Jinhua and 8 artificial intelligence companies; 10 categories of sensitive personal data, as listed in a proposed Treasury rule, and also evidenced in the forced divestiture or acquisition denial of Grindr and Moneygram by the Committee on Foreign Investment in the United States (CFIUS).

In research and development, there is the curtailment of Chinese nationals’ access to federally funded basic research in the physical sciences at US institutes and universities. There are even calls to overturn a Reagan-era directive and withdraw all access in the areas of basic and applied scientific and engineering research.

A confluence of three factors is fomenting this drive towards selective decoupling.

First, the demise of the symbiotic ‘Chimerica’ model, and China’s ‘whole-of-government’ push to retain a larger share of domestic value-added as its growth model transitions from high-speed to high-quality growth. Key to this transition is the production of sophisticated tradable goods by innovative domestic firms, backed by the catalytic role of the ‘entrepreneurial state’. It bears reiterating that public assistance was key in priming the early-stage technological development that birthed the internet, search engine algorithms, AI, speech recognition and touchscreen technology, shale gas hydraulic fracturing, and 3D and 4D seismic imaging.

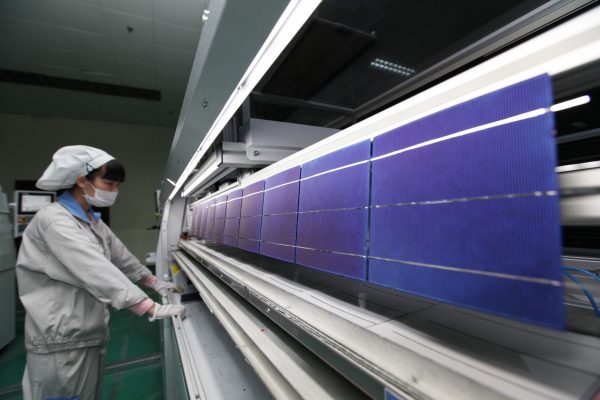

Second, the simultaneous onset of what has been described as the Fourth Industrial Revolution (4IR) and China’s aspirations of sufficiency, if not mastery, across a constellation of ‘intelligent and interactive’ information technology domains. Six key technologies — high-end chips, software, new materials, 5G, AI and integrated circuits — are to be supported by a new mega manufacturing investment fund.

These technologies are geared to harnessing the automation, digitalisation and connectivity functions that reside at the heart of the 4IR. Complexities of military–commercial dual use, the risk of malicious repurposing and scope for surreptitious extraterritorial application of laws, as is inherent to these technologies, means that Beijing’s purposes will also be scrutinised intensely.

The final factor is the rise of China as a potential technological and geopolitical peer and the fear that this instils in Washington, particularly within an administration that refracts national security through the prism of economic security. In addition to occupying the pole position in 5G, Chinese teams routinely feature in the top ranks in object detection and facial recognition at annual computer vision competitions — a feared harbinger of their potentially world-leading aptitude across a range of future intelligent system applications.

The United States and other like-minded countries must be judicious in their response to China’s economic and technological rise.

Beijing is both an economic partner-cum-competitor and a strategic adversary. This differentiation should be inscribed in regulation and affirmed via prudent risk mitigation practices. Controls, denials and restrictions on access should be limited to core technologies and essential security objectives. The cautionary tale of heavy-handed controls incentivising the move of production overseas or US technology being ‘designed out’ of global supply chains counsels for a circumscribed delineation of the ‘national security’ perimeter.

It makes no sense to borrow a page from the lose–lose tariff war and hinder the development or commercialisation of US technology in the zeal to punish China. At a time when Beijing is dipping its feet in the foreign investment security review waters — its first announced review is underway — broad-brush controls would set a poor precedent and invite tit-for-tat retaliation.

The United States and the West enjoy formidable advantages in the building-block technologies that will motor the 4IR. Intelligent applications rely on hardware that is almost exclusively powered by semiconductors. US headquartered firms account for nearly half of all global semiconductor production and with allies Japan and the Netherlands, host 90 per cent of the semiconductor manufacturing equipment industry.

With a mix of carrots and sticks, Washington must leverage this upstream prowess to insist that market-based approaches and technology-neutral state aid, as well as non-discrimination between state-owned, private and foreign producers become the principal basis of China’s industrial and innovation policies. Pillorying Beijing’s state-tilted playing field while filing briefs in federal court to exempt US chip producers from competition rules and kneecapping China’s most dynamic private 5G and AI companies via export controls sends the opposite message — that US actions have less to do with fair and efficient competition and more with thwarting China’s rise.

Until multilateral rules regarding the commercial, privacy, ethical and security implications of this revolution in intelligent information and industrial systems are devised, this conjecture of China’s decoupling with the West will continue to fester. Perhaps a pathfinder group of liberal-minded developed and developing middle powers is ideally placed to devise the extensible architecture of rules that could hasten the recoupling of destinies across the Pacific.

Sourabh Gupta is Senior Fellow at the Institute for China–America Studies (ICAS) in Washington DC.