At the time, China was a predominantly agrarian economy. Policymakers developed the Unified Purchasing and Marketing System (UPMS), which purchased agricultural products at below-market state prices and delivered goods to urban households and industries. Low material and labour costs enabled the urban industries to generate abnormal profits, which could be re-invested to accelerate urban industrialization further.

To facilitate the smooth operation of the UPMS, the government introduced new institutions in three other areas: first by banning free markets so that farmers had nowhere else to sell their products, second by collectivizing agricultural production so that farmers would produce what the state required and finally by enforcing the household registration system so that farmers would have no option other than farming for the state.

This policy framework functioned quite effectively for a while. From the mid-1950s to the early-1970s, urban industries recorded an average growth rate of 11 per cent – a remarkable achievement. But the system eventually collapsed and by the late 1970s it was obvious that the thirty years of policy experimentation with the central planning system had failed.

Throughout the next thirty years, the government implemented a host of major economic reforms, including the adoption of a rural household responsibility system, the privatization of urban state-owned companies and the liberalization of foreign trade. The core element of all these reforms was the re-introduction of free markets into the Chinese economy.

This new policy experiment paid off handsomely. Over this thirty-year period, real GDP grew by an average of 10 per cent a year. Before reforms, China was a closed, agrarian economy. Today China is the world’s third largest economy, and it wields significant influence over international markets, especially the foreign exchange and commodity markets. In fact, it has been proposed that the United States and China should form a ‘G2’ for the joint management of global affairs.

But the re-introduction of free markets into China is incomplete. For the past thirty years, consumer markets have been almost completely liberalized. But the fact remains that Chinese markets are still heavily distorted. The household registration system and the under-developed social welfare system distort labour costs. Interest rates are still highly regulated and the allocation of credit is dominated by state-owned agencies. Land is owned by the collectives in the countryside, and by the state in the urban areas. And energy prices are still set mainly by the authorities.

Some of these distortions, such as state control of energy prices, are the result of deliberate policy decisions. Others, such as the household registration system, result from the reform transitions. But they all share common features, generally depressing factor prices and lowering production costs. These producer subsidy equivalents were estimated to be 7.2 per cent of GDP in 2008.

In fact, this pattern of factor market distortion has a remarkable resemblance to the pre-reform urbanization strategy, which involved the lowering of production costs to maximize industrial growth. But there are two important differences. First, free markets for products help to allocate resources efficiently. Second, the autonomy and incentives they provide for firms and individuals ensure the achievement of technical efficiency.

This new institutional arrangement has been successful, judging from the present rates of rapid economic growth. The producer subsidy equivalents have increased production profits, raised investment returns and improved the international competitiveness of Chinese products. This has artificially lifted China’s economy to levels that would otherwise not be possible.

But the new institutional arrangement is not without costs. The most obvious problems are the structural imbalance resulting from the overdependence of the economy on exports, and the high rates of investment and resource consumption. The result has been a decline in the household income share of GDP, with significant implications for consumption.

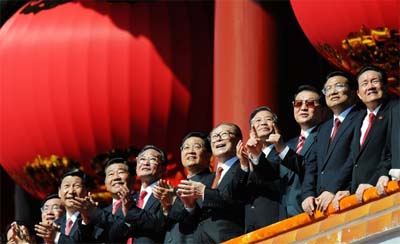

In Premier Wen Jiabao’s words, the current growth path is ‘unbalanced, inefficient and unsustainable’. China will have to make many changes in order to improve the quality of economic growth and to achieve the principles of sustainability. But a central step will be the liberalization of the factor markets: markets for labour, capital, land, energy and the environment.

China spent the first thirty years banning all free markets. It then spent the next thirty years freeing up the goods markets. Let us hope that the liberalization of factor markets will take less than thirty years.

Yiping concluded the article by stating the following:

“China spent the first thirty years banning all free markets. It then spent the next thirty years freeing up the goods markets. Let us hope that the liberalization of factor markets will take less than thirty years.”

It seems that the labour market has already undergone considerable liberalisation or deregulation. Although the household registration system is still in place, the huge number of people who are from rural areas have been employed in urban areas indicates that the constraint of that system is relaxing in terms of people’s mobility and employment.

That is a very significant thing and reflects that the rapid urbanisation and industrialisation has allowed and afforded the opportunity to relax that system and possibly for its eventual abolition. Its tole in the Chinese society has substantially diminished.

The “regulation” of the capital market may also not be as severe as many people expected, especially when one considers the fact that the financial deregulations in some industrialised countries were done not long ago as compared to the long history of the existence of “free market”.

One can probably reasonably expect that the development of capital market or the further deregulations of that market in China will not take too long to realise, given the extensive exchanges between China and the rest of the world and world integration and globalisation.

China has benefited greatly from its economic reforms in the past 30 years. It will not be too difficult for it to establish an efficient factor market for both labour and capital to facilitate its further economic transformation into a world class economy.

Yes, I agree. Liberalization of the factor markets has been an on-going process. It’s not something that will start today. Some of the changes such as increases in labor mobility and market determination of interest rates have already occurred.

But by and large, distortions remain heavy, which, in my view, explains the disconnet between extraordinary growth performance and rising structural risks and between perceived strong global influences/modern cities and its per capita GDP of $3000.

I am as optimiistic on the prospect of China transitioning into a global power. Some of the changes we discussed here require a lot of political will (such as giving up exclusive focus on growth target). Others also need delicate policy skills, such as developing financial markets and liberalizing the exchange rate.

The leadership has demonstrated for the past thirty years both its courage and skill – it put up the best performance at the Olympics, when facing the earthquake and during the global financial crisis. I do have a lot of faith in the current government, but, still, that reduce the potential risks to zero.