In the report, the USTR bluntly declares that China uses foreign ownership restrictions (such as joint venture requirements and foreign equity limitations) and various administrative review and licensing processes to abusively coerce technology transfers from US companies — including forced transfers on non-market terms that favour Chinese recipients.

Conditioning foreign inward investment-related approvals on technology transfer requirements is plainly illegal as per international trade law. China’s WTO trade-related investment measure obligations contained in Section 7(3) of its Protocol of Accession specifically enjoin China to ‘ensure that … any means of approval for importation or investment … is not conditioned on … the transfer of technology’. Beijing is at liberty to determine how open (or closed) its foreign inward investment regime should be, but investment market access liberalisation cannot be conditioned on foreigners having to explicitly transfer their proprietary technologies to gain market entry. Clearly, if China engages in such policies and practices, as the USTR alleges, it is in violation of the law.

Curiously, Washington seems at a loss for words to explain how China’s technology-transfer policies and practices amount to a legal violation of its international treaty obligations.

At a WTO Dispute Settlement Body meeting in Geneva barely five days after issuing the Section 301 report, the USTR let it quietly be known that China’s policies and practices did not implicate any trade-related investment measure violations. China’s practices were perfectly compliant with the law. China’s laws and regulations only appeared inconsistent with two relatively minor ‘national treatment’-related provisions under its obligations on trade-related aspects of intellectual property rights.

This paucity of evidence at the Dispute Settlement Body meeting in Geneva should not come as a surprise. The USTR has consistently released an annual ‘Special 301’ report on global intellectual property rights practices that names and shames countries along the way. China’s practices have been scanned in great detail over the years. If there were significant legal shortcomings, the USTR would not have been shy to slap a WTO case against China, just as it has done in other areas of trade law against Beijing on over 20 occasions. The United States has not done so in a decade because it has never had a durable case to bring.

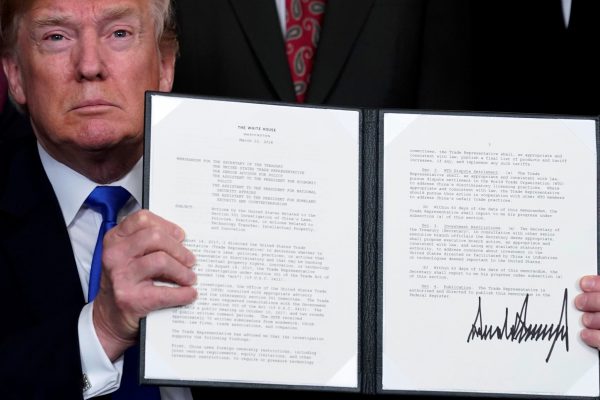

Yet on this meagre evidentiary basis, the Trump administration now proposes to impose a 25 per cent duty on 1333 tariff lines that cumulatively cover approximately US$50 billion worth of Chinese exports to the United States. This would be the most regressive trade policy measure against a major trading partner since the Smoot–Hawley tariff impositions of the Great Depression era.

The United States is not wrong to argue that China uses foreign ownership restrictions and administrative licensing procedures to induce, and in many cases, de facto pressure US companies into transferring technologies to Chinese entities — although these practices appear to have become more implicit following China’s WTO accession. Further, a series of promises by China to liberalise its foreign inward investment regime have not been translated into action.

Equally, China is not wrong to argue that its foreign inward investment regime, including joint venture requirements, is de jure consistent with its WTO treaty obligations — even if it is not regarded by many as legitimate. China is not obliged to provide unreciprocated concessions to the United States in excess of international treaty rules — rules that it had no part in writing but to which it by-and-large adheres faithfully. Bilateral promises to the United States constitute no more than ‘best endeavour’ efforts; they are not legal commitments.

Washington is wholly in the wrong to threaten the imposition of unilateral trade remedies. The tariffs, if imposed, would violate fundamental tenets of international trade law, such as the non-discrimination principle (that WTO trade must be conducted under most-favoured nation treatment) and the predictability principle (that tariff increases must not exceed a certain self-notified ceiling). It would also procedurally violate the United States’ legal obligation to submit its claims first to the WTO’s dispute settlement body and, until that body rules, to stay its hand on enforcement action.

That said, the United States does not have to let China’s foreign inward investment-related practices go scot-free. Bilateral investment flows are an eminently suitable area of reprisal. Investment rules in the multilateral system are shallow — and hence no bar to unilateral remedies. Further, the US president enjoys broad domestic authority to impose a variety of tailored restrictions on Chinese investment inflows and on China-bound technology outflows.

US President Donald Trump could decree that Chinese entities in the United States cannot acquire the proprietary intellectual property of core systems technologies in the strategic advanced manufacturing sectors enumerated in Beijing’s ‘Made in China 2025’ plan. He could further decree that if a US enterprise worked on such a project in China, the project must be performed within a majority- or fully-owned investment structure. For Beijing too, an organic learning-by-doing approach rather than mere acquisition or reverse engineering is a far more durable innovation strategy, especially as it rapidly ascends the advanced technologies ladder.

Trump has a variety of options if he wishes to address China’s industrial and intellectual policy practices from a competitive superiority perspective. The Section 301 tariffs are not one of them. The tariffs as proposed are blatantly illegal and must go.

Sourabh Gupta is Senior Fellow at the Institute for China–America Studies in Washington DC.

Hi, thank you for this illuminating article, and for delineating China’s WTO obligations in relation to rules promoting technology transfer.

Subject to complying with WTO rules, I would defend the right of emerging countries to encourage technology transfer at fair, reasonable and non-discriminatory terms (“FRAND”). It is not the job of governments to make life easy for firms and corporate interests. The job of governments is to promote the long-term interest of workers and consumers.

As a general rule, technology dissemination is in the long-term interest of workers and consumers, not just in emerging countries, but also in developed countries. If WTO rules have the effect of preventing technology dissemination (on FRAND terms), we ought to scrutinise those rules. Do those rules foster the long-term interest of workers and consumers? Or do they foster the corporate interests?

Well, put KC.