The UAE has oil, but Rwanda, Senegal and Mauritius are resource-poor. These stops don’t fit the ‘neo-colonialism’ interpretation of China’s African interests. Although Xi was expected to highlight his signature global Belt and Road Initiative in his African travels, his choice of countries sheds light on another side of China’s efforts to win friends and influence Africa: positioning China as a partner for Africa’s industrialisation.

Just four decades ago, China was a raw material exporter that sent oil and coal to Japan and tin to the United States. Then China began to build special economic zones and started the export-oriented industrial drive that transformed it into the world’s workshop.

China followed a path already laid out by Japan, Singapore and other East Asian countries. Smoky, polluting and often dangerous industrialisation was the first rung on the ladder of structural transformation in China, just as it was in Europe and the United States.

Africa is trying to climb the same ladder. But more than half a century after independence, Africa remains stuck in the trap of raw material exports. Manufacturing makes up only about 10 per cent of value added. For instance, Ghana sends cocoa beans to Switzerland and imports chocolate. Angola exports crude oil and imports nearly 80 per cent of its refined fuel.

When commodity prices are high, African economies boom. In 2014, African countries earned US$144 billion by exporting oil and various ores to China. But economic growth falters when prices fall, as they have recently. In 2016, African exports earned only US$40 billion, which sent many countries into distress.

Industrialisation is the next step in Africa’s development and would add value to Africa’s raw materials, land and the hands of millions of young workers. Yet Africa’s infrastructure and port logistics are notoriously poor. Only 25 per cent of roads are paved. More than 600 million people have no access to electricity.

Until recently, China’s industrial prowess was bad news for Africa. Weakened by economic collapse and controversial structural adjustment programs in the 1980s and 1990s, African countries began to import thousands of products from China that could have been made locally instead. Nigeria’s textile industry collapsed under Chinese competition. In 2007, South Africa negotiated quotas to provide a respite from China’s garment exports.

But a decade ago, production costs in China started to shoot upward. Environmental regulations tightened and wages rose. Since 2011, some Chinese firms have begun to move their factories offshore to Africa, where labour is plentiful and often cheap.

Beijing is paying more than lip service to African aspirations. In 2016, under Chinese prodding, the Group of 20 promised to help Africa industrialise. By that time, China had already ploughed more than US$33 billion into financing Africa’s power sector — a critical input for factories. Another US$41 billion in Chinese investment went into transportation.

Often with support from Beijing, Chinese companies are building special economic zones in Africa to create platforms where Chinese and other firms can cluster together. In 2015, Xi promised US$10 billion toward a China–Africa industrial capacity cooperation investment fund.

US support for African manufacturing is tepid. The African Growth and Opportunity Act allows countries to export goods duty-free to the United States. The biggest beneficiary of the measure has been African oil — not manufacturing exports. The Obama administration launched Power Africa in 2013 to address electricity shortages. As of 2016, Washington had committed US$3.1 billion for Power Africa.

Ethiopia is the undisputed success story for Chinese investment in African manufacturing. There are more than 400 Chinese manufacturing investments in Ethiopia. Some produce goods for major US buyers like Naturalizer, 9 West and Guess.

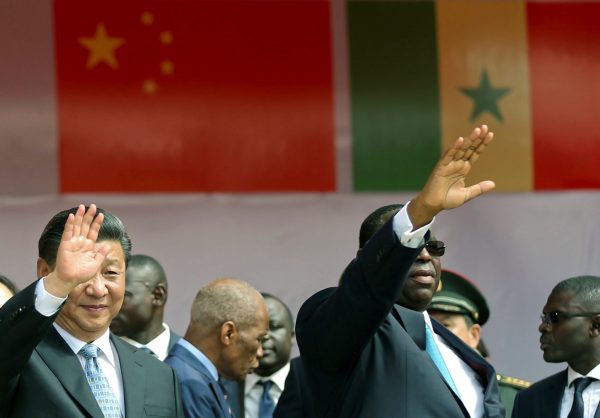

Senegal and Rwanda are watching Ethiopia’s experience. In the hopes of attracting Chinese companies on the lookout for new locations, Senegal hired a Chinese firm to build a new special economic zone near its capital, Dakar. While visiting the country in late July, Xi promised to prioritise Senegal’s industrialisation. China may even finance the zone’s second phase.

Rwandan leaders have long looked to China for inspiration. Rwanda’s high population density makes a labour-intensive strategy appealing. Two decades after a devastating genocide, Rwandans now produce paper goods, uniforms and polo shirts in Chinese factories in a special economic zone in the capital, Kigali.

In contrast, Rwanda imposed tariffs on used clothing and shoes from the United States in order to boost local manufacturing in early 2018. The US Trade Representative’s Office threatened to start a trade war and imposed sanctions on Rwanda’s US exports.

Xi’s final stop was Mauritius, a prime example of how the Asian-style industrialisation model can be successful in Africa. In 1970, the small island set up industrial zones that attracted an earlier generation of Chinese manufacturers from Hong Kong and Taiwan. Learning from Asia, Mauritius developed a diversified economy with perhaps the best business environment in Africa.

The next step was taken in April when Mauritius began negotiating Africa’s first free trade agreement with China to broaden its exports. Xi’s visit pushed those negotiations forward.

Deborah Brautigam directs the SAIS China Africa Research Initiative at the Johns Hopkins University School of Advanced International Studies.

This article was first published here on 24 July 2018 as ‘Xi Jinping is visiting Africa this week. Here’s why China is such a popular development partner.’ in The Monkey Cage at The Washington Post.

The problem when China ‘helps’ with mining or with industrialization is their ‘bait and switch’ management. They ‘sell’ their help and capital to a small nation with the promise of employing native people in most employment positions. Any time one local cannot turn up for work – for any reason – China replaces that person with someone from China. It’s more about jobs for the Chinese and sucking the small nations dry of resources and abilities for the advancement of China. Exactly like it was done back in the 16th – 18th centuries. The small countries gain nothing in the end. So read in an earlier article on the EAF and told to me by black cab drivers here in the US. So sad.

The OBOR CPEC section has labor from China, though unemployment is high in Pakistan. Balochistan natural resources are being exploited, but the locals are protesting – the Pak army has a special division to protect Chinese labor working on the OBOR & Gwadar. Only agenda China has is either getting natural resources, exporting labor or military leverage.

China tries to follow ‘Heads I win, tails you loose’.