The most direct effect of ODI is changing the income distribution of social groups in the host country. Those with positive views of ODI believe it can significantly increase the demand for labour in the host country and contribute to an improvement in labour conditions. But local owners of capital are likely to encounter rising costs and intensified market competition.

Those with a negative view of ODI believe that it can widen labour income gaps and worsen conditions for low-income groups. A pro-labour government may encourage ODI inflows that contribute to improvements in workers’ wellbeing, while a pro-capital government may encourage ODI inflows that will lower labour costs. For these reasons, the type of political obstacles that investors encounter are closely related to issues of redistribution in the host country.

Employment security is the biggest political appeal of ODI. ODI enterprises generally have a competitive advantage and offer higher wages and more stable jobs. But ODI inflows may have a negative effect on the employment of low-skilled workers in the recipient industry.

The effect of ODI on income distribution among different social groups in a host country mainly hinges on the nature of the ODI and the development level of the host country. Groups that have or are likely to see their interests affected will use existing political mechanisms to block the entry and operation of ODI. For Beijing, 84 per cent of blocked Chinese investments are blocked in developed economies, most significantly those investments into the United States. China has encountered relatively fewer hurdles in developing markets.

China’s ODI often has a major bearing on domestic industrial development in developing countries. China’s ODI projects are often seen as offering political and economic support for the incumbent government and thus are prone to fierce backlash from opposition forces. Investment agreements signed by Chinese investors with Myanmar’s military government were cancelled after the country initiated democratic reforms.

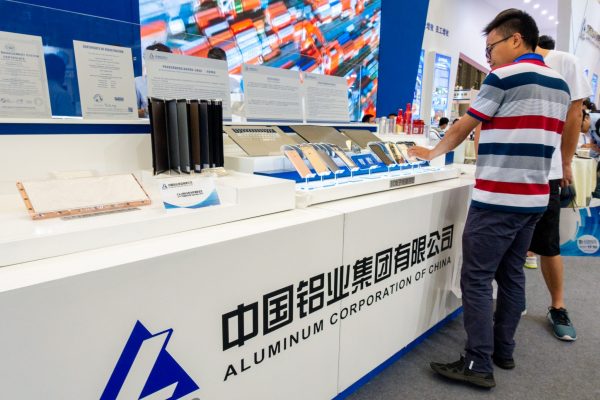

In developed countries, Chinese enterprises may face competition from their local rivals who often make use of election politics and concerns about national security to thwart investment and acquisitions. Chinalco’s competitor BHP produced and made use of negative propaganda to play up an alleged threat that the Chinese company posed to Australia’s national security. The approval of the Chinalco investment project was delayed and Rio Tinto turned to BHP to form a new joint venture.

The higher the technological advancement of a host country, the more probable it is that investment by Chinese enterprises in local markets will be blocked. Host countries with relatively high technological capabilities are worried about Chinese enterprises ‘stealing’ their key technologies and weakening their competitive economic edge.

The better the bilateral relations, the smaller the probability of Chinese enterprises encountering investment hurdles. Investments by Chinese enterprises in sensitive industries — such as telecommunications, agriculture, forestry, animal husbandry and fisheries, mining and construction — are more likely than others to be blocked.

Investors should break up large-scale investment into several smaller investment programs to avoid attracting the attention of the host country’s government, community and media. Chinese enterprises generally lack transparency making it very difficult for the host country’s society to determine their investment motives and development philosophy.

Chinese enterprises should invest in industries with easy review procedures and avoid directly entering sensitive industries. They should gradually increase their investment and establish a good reputation before they start acquiring local enterprises in sensitive industries to ease local concerns.

In response to the concerns of host countries over the loss of key technologies, Chinese enterprises should enhance brand protection and intellectual property rights of the enterprises in which they choose to invest. Chinese enterprises should also provide support for the companies they invest in so they can hire more research and development (R&D) staff, improve their research facilities and increase R&D inputs.

China can adopt clearer strategies in response to the political backlash triggered by its ODI activities. Chinese enterprises should understand host countries’ regulatory frameworks and review procedures.

Chinese enterprises, especially state-owned enterprises, should improve their transparency in line with international standards. They should clarify their relationship with the Chinese government, their investment goals and policies and their future development plans. While investing in sensitive and important industries, they should avoid offering unrealistically high prices or shouldering excessively high business risks. This can easily arouse suspicion from the host countries.

China should actively participate in the establishment of international investment rules to create a favourable environment for Chinese enterprises investing abroad.

Chinese enterprises should also build an image of themselves as politically neutral to better cope with the distribution effect and local politics of the host country. Before the launch of their investment projects, enterprises should ensure their investment projects can serve the interests of local communities. Chinese enterprises should also thoroughly assess the possible reactions of local competitors and related interest groups and establish communication with local media and non-governmental and community organisations.

Bijun Wang and Xiao He are Senior Research Fellows at the Institute of World Economics and Politics (IWEP) of the Chinese Academy of Social Sciences (CASS).

This article is abridged from Bijun Wang and Xiao He, ‘What types of Chinese ODI activities are most prone to political intervention?’ in Ligang Song, Yixiao Zhou and Luke Hurst (eds.), The Chinese Economic Transformation: Views from Young Economist, China Update, ANU Press, 2019.